The banking and financial sectors have undergone a significant transformation in recent years due to technology, causing a rapid change in the way the industry operates. The industry constantly strives to offer a wide range of solutions to customers, making digital transactions more accessible. The Indian government, during its recent G20 presidency, has also emphasized the importance of digitalization and ensuring that everyone benefits from it.

According to the Ministry of Commerce and Industry, India accounts for 40% of all digital transactions. The widespread use of smartphones and high internet penetration has led to a proliferation of financial services. To fully harness the potential of digitalization and the internet, in the 2023-2024 budget, Nirmala Sitharaman, the Union Finance Minister, expanded the range of Digilocker services, making it a comprehensive solution for online document sharing.

By offering a new way to collect and use data, Digilocker will enable micro-small and medium enterprises to access more documents, extending innovative services to businesses. Fintech companies will be able to develop financial products and streamline the onboarding process, including KYC verification and system updates. This will also help to reduce operational costs, as it eliminates the need for extensive paperwork and endless queues, which were previously associated with banking.

The use of technology in the KYC process is helping to cater to the unbanked sections of society, who struggle to keep track of multiple documents. Furthermore, the implementation of digital transactions is essential to India’s growing fintech industry and rural areas where cash still dominates. These advancements in the industry have led to a reduction in labour needs, and fintech and NBFCs, which aim to improve access to financial products for underserved populations, have received a positive response from the government. By incentivizing the development of a strong and inclusive financial system, India is making progress towards achieving its goals. The growing demand for digital banking experiences is also driving fintech startups to create innovative solutions that meet the needs of underserved populations, thus helping to create a more inclusive financial system in the country.

According to Ram Shriram, CEO of Mahagram, the expansion of Digilocker services by the Indian government will enable fintech companies to develop innovative financial products and streamline customer onboarding, making it more accessible and efficient for underserved populations. These advancements are helping to create a more inclusive financial system, driving growth and development in the financial sector in India.

The banking industry has undergone a significant transformation due to technological advancements, with fintech companies playing a crucial role in changing the way people connect and conduct business. The growing demand for a digital banking experience among rural populations is also transforming the entire banking industry. Fintech startups are gradually bridging the gap between rural and urban areas, shaping the digital economy.

Demystifying FinTech Jargon:

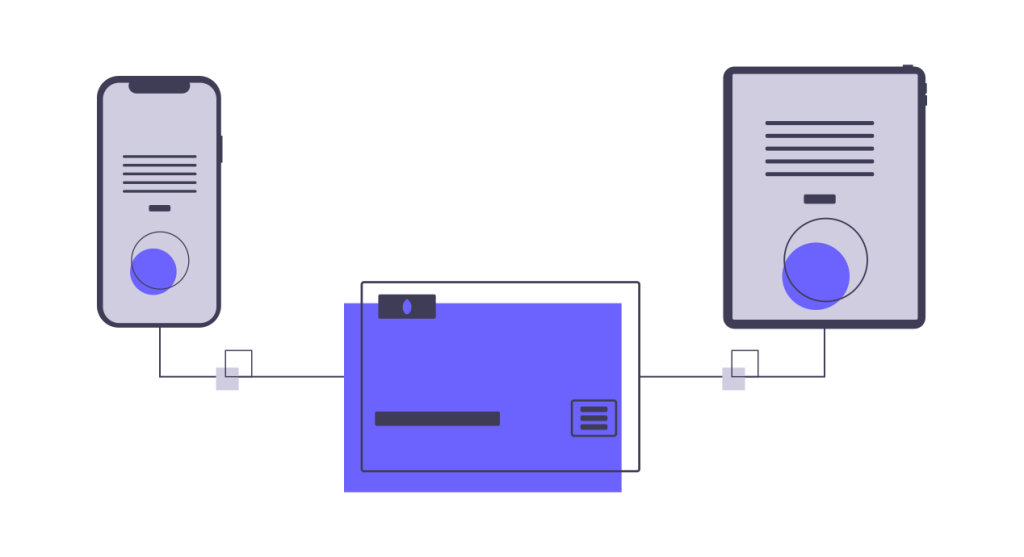

Digilocker is a digital locker service provided by the Government of India, which enables citizens to store and access their important documents in a secure digital format. It aims to eliminate the need for physical documents by providing a digital alternative that can be accessed from anywhere using a computer or smartphone. Digilocker offers a unique username and password to access digital documents, which can be shared with government agencies and financial institutions. It streamlines processes such as KYC verification and document sharing, making it easier for individuals to access financial services.